The Boring World of Intelligent Investing: How Do You Manage Your Free Time?

Value Investing is one of the notable styles of investing referred to as intelligent investing. This philosophy of making money in stocks was birthed by Benjamin Graham, as its high priest. Ben Graham and his protégée Warren Buffett and several others agree on a set of investing standards and tenets. That intelligent investing is first, the idea of treating stocks as businesses. Second, acquiring these assets through the use of fundamental analysis. This allows the investor to employ both quantitative and qualitative due diligence.

The end-game is to hold businesses in a focused portfolio. Their intrinsic or underlying value should be higher than the prevailing market capitalization. Even better, the appraisals of institutional analysts from Wall Street. There has to be an additional fair margin of safety for investing. The intelligent investor will have plenty of time on their hands as a result.

In this article, I share ideas and suggestions on how an intelligent investor could use their free time. This passive approach to stock picking discourages practitioners from unnecessary activity that will certainly cause more harm than good.

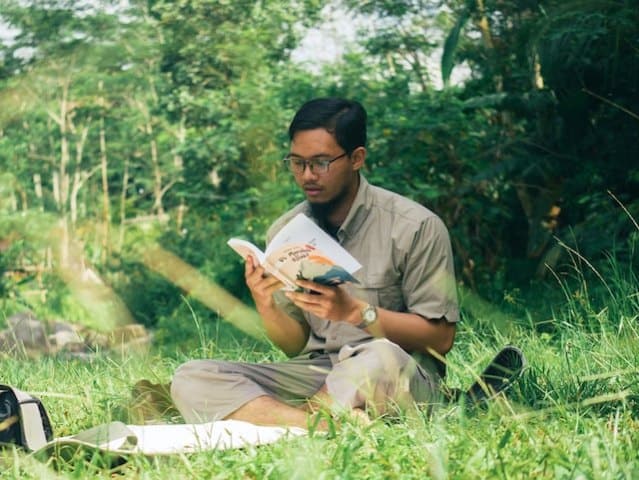

Read Business Books

The intelligent investor (buy book | Free Audio Book) today should free up his mind from market induced anxieties. He must be focused solely on fundamentals. The figures seldom change on a day to day basis. This emotional pit is just a mind game that Mr. Market (a nickname for the stock market) plays on the psychological front.

Read books on business and investing. Do not shy away from entrepreneurial titles and business biographies either. An active reading list of 50 books a year is recommended. On the other hand, make it a point to revisit the books you’ve read the previous year. You will receive a refreshing perspective that will add another brick to your mental model. This will result in better intelligent investing activities that pay off.

Read Annual Reports

Annual reports present themselves as one of the goto resources of research by intelligent investors. These publications and manuals as published by public companies are part of their statutory obligations. They make up the core of the listing requirements of the stock market.

The individual beginner investor will find a treasure trove of data in the letters to shareholders. The financial reports section with show the math behind the bottom line. The foot-notes will also carry their very own conclusive inclusions. They do not make for interesting reading, but they certainly lead to long-term edification. Building up your own mental library is pivotal to the intelligent investing mindset.

Take Your Hustle Seriously

As a small investor picking individual stocks to grow your nest egg, you might also be nurturing a main or side hustle. Your objective should not just be for income growth, but scaling the venture. You can develop sufficient capital to be eligible for an IPO.

Aspire to take your small business public. You will become a different kind of investor. You are likely to have the lion’s share in the stock pool. Then you will also be in the position to see the world from the other perspective. You will be responsible for creating a brand that other value investors will come to love and respect.

Read About Your Industry or Niche

Don’t be lazy when it come to mastery of your own craft. As you pick up the pace on your reading list, don’t forget to learn more about your niche. Warren Buffett refers to this as your circle of competence. Intelligent investing is about growing your competence over time. However, do observe and mark the circumference and all its perimeters.

Mastery of a few is always significantly better than being average on a wide range of things. The benefit a small investor gains are in two folds. Firstly, they will have more capacity for analyzing publicly listed stocks. Secondly, they will always have a competitive advantage in the industry and niche they operate in.

A Few Parting Words – about Intelligent Investing

For value investors who are true to their craft, excessive activity does more harm than good. When trading is kept to a minimum, speculation will have no room to thrive. So the free time of the intelligent investor should be better spent on expanding his circle of competence. This includes, building a more durable mental model for better intelligent investing. There is a great divide between investing and speculation. One of the differences lies in activity. One sees activity as a virtue, but the other see it as a vice. pick your side.

Has inactivity served you in your investment journey? If so, how did you use the available ample time. Please comment below with your views.

Most Popular Posts:

- 12 Giant Steps Financial Freedom Seekers Take To Retire Early (Epic List !!!)

- Learn to Trade Stocks Step by Step for Beginners (A Comprehensive Guide)

- Top 10 Financial Freedom Courses (Mostly FREE)