Financial freedom is the inspired approach for you to obtain enough assets such as savings and investments, and spendable cash in the bank to finance the lifestyle of choice; for yourself and your family. Do you know how much money is needed for financial freedom nowadays?

Many people are trying to reach a goal amount of $1,000,000.00. Without any form of analysis or calculations, this is just an estimate at best. It may even fall short of the right figure. A million today is worth much less than it did three decades ago, and it will certainly be worth a lot less by the time inch into retirement.

So, the all important question to answer is, how much money is needed for financial freedom? The exact amount is pretty much relative. The figure is based or founded upon a few criteria that we will be digging into at this moment as we create your financial independence road map.

What Is The Real Meaning Of Financial Freedom?

As disclosed above, financial freedom or financial independence is a destination in the future. When this future date is ripe, you’re expected to receive passive income that covers all your living expenses over the balance of your life. These are payments from assets and investments that you set up during the course of your working life.

The financially free individual also has the choice to do the kind of work or hobby they want. This could even be a vocation of love – to volunteer and serve in a role without pay, or to journey into the way of philanthropy.

The General Consensus Out There

The world today see financial independence as a rich life. This could be very deceiving indeed. The picture of a mansion, luxury apartments, supercars, and retreats to exotic holiday destinations are usually portrayed.

Premature Retirement

Retiring early at the age of 30 or 40 may not be a good idea after all if you really want to be rich. It’s an unfortunate and unethical brain-washing going on in the internet. Why would anyone want to give up a career at the ripe age of 30 or 40 and retire? Although you may have hit your financial freedom goal amount, will the 5 figure annual payouts from your investments ever going to be satisfactory?

Opportunities for Career Growth

You could be missing out on the best career life of advancement ever. According to some stats out there today, about $66,928 per year (9.1-percent increase from 2020) is what the middle income U.S. household is spending annually according to a recent (2021) Consumer Expenditure Survey. This is the factored payouts expected from investments you may have set up.

The Hard Truth

This feels cozy on paper today. But unfortunately you’re not rich. Because you can’t buy the big nice stuff with cash. Like a second home, a high end luxury vehicle (that you’d want to replace every year or so), exotic long-stay vacations, college tuition and even MBAs for your kids, big wedding gifts for family members, and some leftovers for grandchildren.

True Financial Freedom: Your Personal Path To A Purposeful End

Are you still asking how much money is needed for financial freedom? – the narrative above will begin to change the paradigm. So you see that you can’t afford to stop working when your investments begin to pay you $50K per year – amounting to $4,166 per month.

Here is a better approach to the financial freedom journey. Create multiple levels of financial independence.

1. Financial Freedom Level 1

Let the first level be the standard perspective that the world portray. Reach a million and a quarter dollars ($1,250,000) and have $50K annual payouts to cover expenses.

2. Financial Freedom Level 2

The next level, work in your dream career or role – perhaps your own business. Grind your way to become a multi-millionaire with active entrepreneurship. Leave everything you’ve accumulated together with your passive income compounding year upon year.

3. Financial Freedom Level 3

Thirdly, become a billionaire philanthropist. Why not? Go beyond the selfism paradigm and do some good for the less fortunate folks around you. You can let your giving be as creative as you want it – coupled with global travels and new social entrepreneurship ventures worldwide.

Furthermore, if your decade or so stint with your employer or side-hustle could make you $1 million or $1.25 million (the average financial freedom target out there today), why not set another goal for a higher net worth threshold. Become a multimillionaire with at least $10 million. You can certainly do this by working less than you did while accumulating your first million.

You could open yourself up to great opportunities of entrepreneurship and networking with other millionaires. And within a twinkle of an eye, you could be in the $100 million club. To reach this audacious milestone, you’d need to find a mentor. The fastest way to get mentoring from a real millionaire who has failed and succeeded is by accessing an online course they’ve created.

Investigate How to achieve Financial Independence and Freedom as Fast as Possible by Grant Sabatier. He is the author of the international bestseller Financial Freedom and very active in the modern financial freedom movement.

You could also cultivate the mindset of listing your business on the stock market some day. With an exit strategy, you could also sell all your stocks to another investor for an 8 or 9 figure pay day. You can be as ambitious as you want. Keep pushing ahead to reach the big BILLION mark. All this is possible in your lifetime.

How To achieve This Goal

Self Investment & Self Improvement

Clearly this is one of the most important starting points. You have to become a better version of yourself. Self assessment is required to know your current state of thinking. Understand that growth happens when we add value to ourselves intellectually.

Read About Wealth

Create a solid reading habit and a reading plan. Buy books on personal finance and areas of your calling or career to help develop you faster. Consider creating a reading list by searching for online articles like the 20 Investing Books Every Beginner Must Have. Have a healthy appetite for courses, as well as local seminars in your city.

Your Health Is Your Inner Wealth

Invest in your health. Never ignore your diet and fitness. You’ll need to sustain your financial freedom journey that way. A healthy body and a healthy mind is a requirement for accumulating wealth. Because the process requires a lot of hard work of both mental and physical sacrifice.

Your Mindset Is Key

Furthermore, you’d have to keep asking yourself the important questions. In every situation related to your life or financial decisions, ask yourself: what did I do right? or what would I do differently? How do I learn and grow faster. Be determined to become a generous person. Not seeking your personal interests alone, but also enriching others. Cultivate this money mindset.

Lay Out Your Goals And Plans

in order to undertake any journey, you’ll need to review your road map. Exactly how much money is needed for financial freedom – should be clearly expressed or estimated here. Keep it simple. This process can be reviewed or revisited at a later time to polish up a few rough edges later. Avoid paralysis by analysis at this point.

First question you need to ask is: What will I do with all that money? Beyond just surviving or thriving, have a purpose. If you plan on retiring early, will you take up writing and become a published author sharing the path you took to attain financial freedom? Will traveling globally rather bring meaning if you adopted philanthropy alongside it?

What will your life look like? Will you live low key, or ramp up your consumption to another degree? determine a goal amount you’d like to reach, and the time that you want to achieve it at. If you plan on making $1 million within the next 20 years, its quite conservative and achievable. A million dollars in 10 years is what a lot of people would also shoot for. There are quite a few apps today that will give you good numbers if you tap in important variables such as your current age, income, monthly contribution amounts, and the goal sum.

Look at the long term, and also the short. Your personal, family and lifestyle goals may not seem relevant when making financial plans. But on other hand, they are most pivotal in keeping you sane and focused. When it all seems like a big mess at times, they will pick you up and motivate you.

Important Concepts & Calculations

Some important concepts that will help you to determine how much money is needed for financial freedom are listed below. This should be a guide that will get you off to a good start. You can’t go wrong at this point if you implement this into your arsenal for building wealth or for early retirement.

The 4% Rule

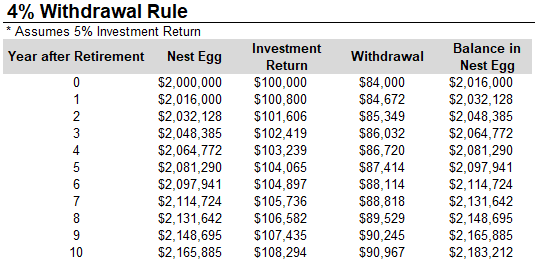

The 4% rule has been around for ages. This is the basic principle or rule of thumb that determines how retirees can make annual withdraws of 4% or so from their retirement funds. It is based on the assumption that the portfolio of the retiree will grow at an average of 7% or thereabout with inflation hovering around 2%. He therefore withdraws a safe maximum of 4%.

This 4% is only recommended for the initial withdraw in year one. The withdrawal dollar amount from the second year onward should be adjusted consequently for inflation.

A typical example is as follows: If you have an investment nest egg of $1,000,000 at retirement, the 4% rule suggests that you could withdraw up to $40,000 in year one. This principle is slowly getting outdated and it should serve as a conservative starting point in your retirement preparations.

Read further for a deeper understanding on The 4% Rule.

The Crossover Point

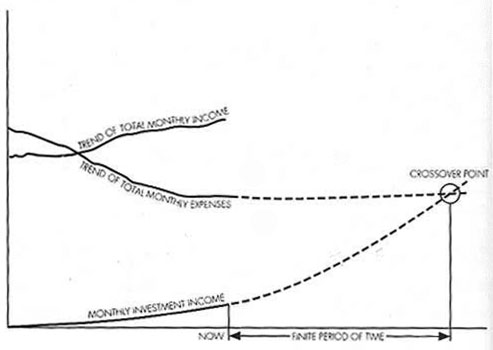

The Crossover Point is also a neat concept to look at. It is a theory was discussed in the book, Your Money or Your Life – and states that, as you accumulate and master money to reach your investment goal, there will come a point at which your investments may grow faster that your scheduled withdrawals.

This should be seen as a positive event that will help your investment portfolio gain grounds against inflation in the long-term.

Gain a deeper insight of this concept here.

The 50/30/20 Budget Rule

The 50-30-20 Budget Rule says, 50% of your current income should be used to pay for your current living expenses or your needs. Leaving 30% for your wants, then 20% reserved for savings and investments – and paying off debt.

This is a guide that will ensure that you save money adequately. It will put the brakes on your needs which are the most essential expenditures in your life, and also your wants which could get out of hand sometimes.

The 20% savings will essentially begin to build an emergency fund of at least 3 months of your cost of living, they pay off part of any outstanding debts. It will eventually be used when you start investing in assets such as stocks; that will yield the fruits of your financial freedom.

For more elaborate information on the 50/30/20 Rule, click here.

Investment Vehicles Available

Once we’ve covered how much money is needed for financial freedom, and discussed Important concepts and calculations, we can now dive into the investment types available for achieving the goal amount. Although the options are literally limitless out there, we’ll keep things simple here.

A Money Market Account Or Fund

A Money Market investment is also called a cash equivalent position. Both Money Market Accounts and Money Market Funds are best suited for short-term needs of an investor. They earn returns and interests that are higher than a savings account, but lower than Equity Mutual Funds.

They have maturity that are usually less than a year and are very liquid – allowing investors to withdraw funds easily with minimal costs. Although, they’re not useful for long-term investing for your financial freedom, they have their place in your portfolio allocation strategy.

An Index Fund or ETF

An Index Fund is a mutual fund that tracks a basket or collection of investments. An ETF on the other hand, is a mutual fund that trades on the stock market like an individual stock. They are very similar but not the same. They are a passive investing strategy that have little management costs. These funds are good long-term investment options that track a given index – such as the S&P 500.

They are definitely simple to hold and manage. The differences between Index Funds and ETFs may vary along the lines of to management fees, transaction costs, taxes, other qualitative differences, etc.

individual Stocks

Stocks represent a fractional ownership of a existing business. It is a financial asset or paper asset traded (mostly) publicly on the stock market. Stocks produce a much higher yield than other investments such as bonds, gold, cash, treasury bills, etc.

An investor in stocks must assess the risk(s) involved in buying, holding, and managing a portfolio of stocks with its accompanying costs. Diversification will also become essential strategy to minimize risk. An easy way of getting to know the investing environments is to play a Stock Simulator game with real time data but using play money.

For a closer look at how to find a broker, research and buy your first stock, read this article for step by step path to individual Stock Investing.

A Word of Caution

Finally, on our journey to build wealth and retire early, we first obtained how much money is needed for financial freedom. It is important to note that we may encounter a few bumps here and there along the way. it is essential to therefore arm ourselves with a few strategies to help you weather the unforeseen financial storms that seem to come to almost everyone when they least expect it.

Emergency Accounts

An Emergency Account will contain some amount of cash cushion in case you lost your primary source of income. Save up at least 3 months of living expense in a short-term yield fund. Build it up to 1 year equivalent of your living costs. Cover your bases with this cushion against the unknown.

Learn a whole lot more from our How to Build a Durable Emergency Fund to Weather Financial Storms article.

Diversification

Diversification is a portfolio strategy that brings a sort of balance to your investments. It is used for minimizing risks where the purchase of equity investments is involved. As you diversify with owning several stocks of varying qualities and sectors, you should also allocate your funds into different asset classes. for example: Stocks, Bonds, Index Funds, Cash.

Portfolio Re-Balancing

Portfolio Re-balancing entails the frequent review and assessment of an investment portfolio from time to time; to ensure that the original state of asset allocation ratios remain unchanged. Because over time, certain investments such as stocks may outgrow or under perform their original threshold. Although this volatility may not be unusual, it may throw off the original objectives of your investment plan such as risk tolerance, etc. Occasionally buying and selling a position for tune-up purposes could also incur transaction fees as well as missing out on further growth in rising stock prices.

Insurance & Recession Watch

Beware of earthquakes, hurricanes, pandemics, recessions, market crashes, and wars. Don’t forget car accidents, domestic & forest fires, disability, etc may occur in the life of an active investor pursuing financial freedom.

Look out for these events. I’m not saying we need to focus on them, but let’s keep them in mind as we set personal financial goals and make the critical decisions that would make or break our financial future. Make it a point to purchase adequate insurance. Find policies that make sense, that are a good fit for your needs.

This will keep your family comfy with a sense of protection. You’ll have very little out-of-pocket expenses during those unfortunate times.

Concluding Your FI Goal Amount Analysis

It is possible to retired early when you reach financial freedom. But you’d still need to work at managing your own money. Perhaps a few hours a week? Or are you planning on seeding this responsibility to someone else? You can hire a wealth management firm or yet still learn about money and take complete responsibility for your own investment portfolio growth.

Understand that all this heavy lifting and personal wealth management is on you. You are the only one who cares about your money enough to lay a solid foundation of learning and earning.

Send us feedback in the comments below if you’ve started this all important financial freedom journey already, or how far along have you gone with the desire to be financially free. You may also tweet us 😉 @FinancialFSage

Most Popular Posts:

- 12 Giant Steps Financial Freedom Seekers Take To Retire Early (Epic List !!!)

- Learn to Trade Stocks Step by Step for Beginners (A Comprehensive Guide)

- Top 10 Financial Freedom Courses (Mostly FREE)

Little drops of savings make a mighty investment nest egg by 65

Great post Simon, I’m hoping to deploy the 4% Rule in about 4-5 years when I leave corporate life. In the meantime, I’ll continue building my passive income streams and helping others realize they can too! Great Post!

Thanks Jim, you’re doing a marvelous job yourself. You’re already ahead in the game if you see an exit within 4-5 years. And your service to mankind with Investmentsoup.com is awesome.